08/12/ · There used to be a % winning strategy revolving around gaps but it no longer works because most brokers don’t offer guaranteed stops anymore. You’d hedge a pair just before closing on Friday and put a guaranteed stop pips in each direction Forex Gap Trading Strategy Rules-How To Trade Forex Gaps You need to choose a currency pair with a high level of volatility. GBPJPY is a good example but any currency pair that When the trading day starts on Monday, look to see if there is a gab. Make sure that the gap is at least 5 times the Estimated Reading Time: 4 mins The final type of trading gap is known as an Exhaustion gap. As the name suggests, this type of gap indicates a trend reversal following a long and prominent trend. The best way to trade the exhaustion gap is usually to watch the following candle and upcoming candlestick pattern or price action. In the chart below, you can see that the following candle after the exhaustion gap formed the Doji candlestick pattern

2 Simple Forex Gap Trading Strategies

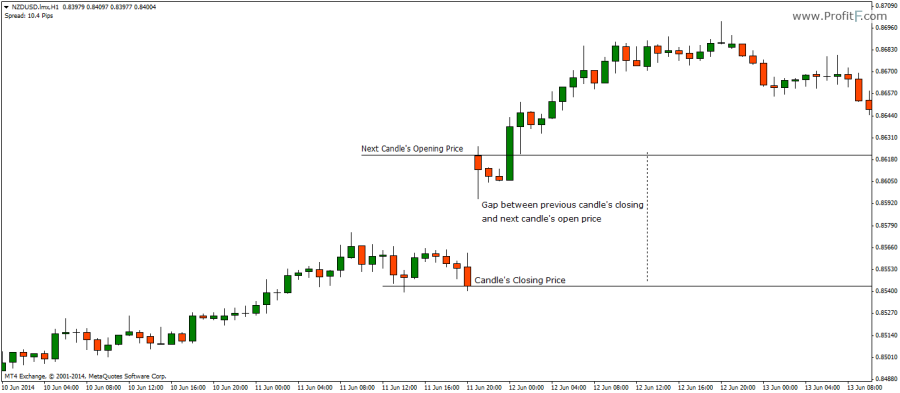

Forex Gap Strategy — is an interesting trading system that utilizes one of the most disturbing phenomena of the Forex market — a weekly gap between the last Friday's close price and the current Monday's open price, strategy forex gap. The gap itself takes its origin in the fact that the interbank currency market continues to react on the fundamental news during the weekend, opening on Monday at the level with the most liquidity.

The offered strategy is based on the assumption that the gap is a result of speculations and the excess volatility, thus a position in the opposite direction should probably become profitable after a few days. The last gap gives a wrong signal and yields a medium loss. The net total profit was 1, pips in 7 weeks — not that bad. Use this strategy at your own risk.

com can't be responsible for any losses associated with using any strategy presented on the site. It's not recommended to use this strategy on the real account without testing it on demo first, strategy forex gap. Do you have any suggestions or questions regarding this strategy? You can always discuss Forex Gap Strategy with the fellow Forex traders on the Trading Systems and Strategies forum.

MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers strategy forex gap Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Strategy forex gap Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service.

Advertisements: RoboForex — Over 8, Stocks and ETFs. Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Forex Tools Forex Strategies.

Features Regular trading with clear rules, strategy forex gap. No stop-loss hunting or premature hits. Statistically proven profit. You have to open position at the week's beginning and close it right before the end. How to Trade? Select a currency pair with a relatively high level of volatility. But other JPY-based pairs should work too. By the way, it's a good strategy to use on all major currency pairs at the same time. When a new week starts look if there is a gap.

A gap should be at least 5 times the average spread for the pair. Otherwise it can't be considered a real signal. If Monday's or late Sunday's if you trade from North or South America open is below the Friday's or early Saturday if you trade from Oceania or Eastern Asia close the gap is negative strategy forex gap you should open a Long position, strategy forex gap. If Monday's open is above the Friday's close the gap is positive and you should open a Short position, strategy forex gap.

Don't set a stop-loss or a take-profit level it's a rare occasion but stop-loss isn't recommended in this strategy forex gap. Right before the end of the weekly trading session e.

95% Forex Winning Strategy - Big Banks Secrets - Step By Step (Part 1)

, time: 55:13Forex Gap Trading Strategy

24/06/ · An alternative method to use within a forex gap trading strategy is to watch the price action on shorter time frames, and then enter a trade in the direction of the fill using a tighter stop loss once the price action indicates a move is likely blogger.comted Reading Time: 8 mins Forex Gap Trading Strategy Rules-How To Trade Forex Gaps You need to choose a currency pair with a high level of volatility. GBPJPY is a good example but any currency pair that When the trading day starts on Monday, look to see if there is a gab. Make sure that the gap is at least 5 times the Estimated Reading Time: 4 mins 08/12/ · There used to be a % winning strategy revolving around gaps but it no longer works because most brokers don’t offer guaranteed stops anymore. You’d hedge a pair just before closing on Friday and put a guaranteed stop pips in each direction

No comments:

Post a Comment