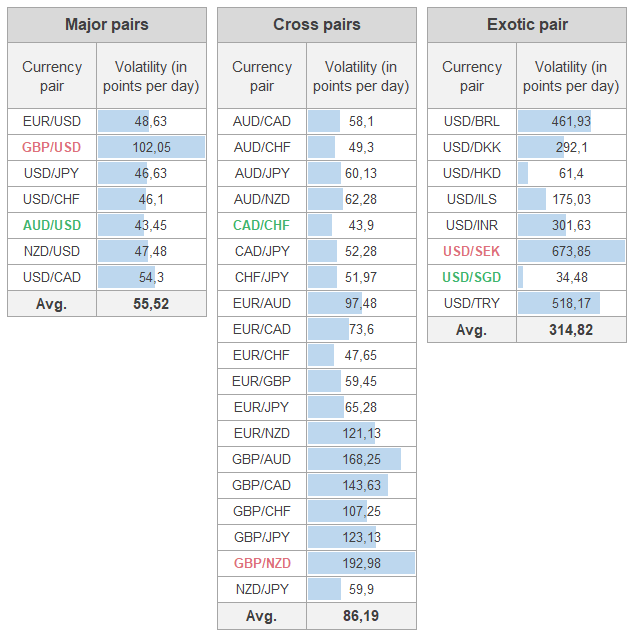

The following currency pairs have shown the most volatility in AUD/JPY (average volatility – %); AUD/USD (average volatility – %); 26/08/ · Currency Pairs and Volatility. After researching the most volatile currency pairs in , it is important to learn some basics about the currency pairs in the forex market and the three main categories. Major Pairs: The major pairs are the most traded major currencies against the US Dollar. These pairs enjoy high levels of liquidity 02/03/ · Most Volatile Forex Pairs Most Volatile Currency Pair in is GBP/NZD; Least Most Volatile Currency pair in is CAD/CHF; In the chart below, we display the least to most Volatile Forex Currency Pairs for

Most Volatile Currency Pairs

Home » Forex Trading Tips » Most Volatile Forex pairs, most volatile forex pairs 2021. Volatility is a forex term used to measure to what extent market prices fluctuate upwards and downwards in a particular time period. Volatility is also associated with risk. Volatile currency pairs experience dramatic upswings and downswings while less volatile currency pairs experience smaller, incremental price movements. In other words, most volatile forex pairs 2021, volatility is a measure of standard deviation.

Forex trading risk increases with volatility but volatility is also good news for forex traders because it increases opportunities for trades and to make profits. The most important decision you make as a forex trader is which currency pairs to trade. Your decision is based on your trading strategy and your appetite for risk.

Before choosing currency pairs to trade and opening a position, you need to know more about its volatility and what you need to do to protect yourself from financial loss. Most volatile currencies in the forex market. The most volatile currencies on the forex market are the exotic currencies which move on average more than points per day. However, exotic currencies are not necessarily weak or soft currencies. They are mostly the currencies of emerging or developing countries on continents like Africa, the Middle East, Asia, and the Pacific.

These countries typically have small but strong economies. Exotic currencies are more popular among forex traders who like to trade on volatility. Rapid price fluctuations lead to dramatic highs and lows in the currency values and this presents volatility traders with excellent opportunities to make profits and losses. Exotic currencies generally demand higher spreads to protect traders from unfavourable fluctuations. The spreads are far higher for exotics than they are for major and minor currencies.

The Australian Dollar AUD and US Dollar USD is possibly one of the most popular currency pairs to trade because of the interest rate differential. The latter is the difference in interest rates between two securities. Australia is a developed nation and has one of the highest interest rates. Carry trades involve a forex trader most volatile forex pairs 2021 a currency with a relatively low-interest rate while buying one with a higher yield.

Carry traders make a profit or loss from the difference in interest rates. The Most volatile forex pairs 2021 Dollar USD and South African Rand ZAR is a highly volatile currency pair, largely due to dramatic price movements in gold, most volatile forex pairs 2021. South Africa is a major exporter of gold and gold exports are always fixed to the USD. Apart from gold, factors that affect the stability of the country relate to political and economic upheaval which affects interest rates, GDP growth, most volatile forex pairs 2021, unemployment rates, inflation, and balance of payments.

The Great Britain Pound Sterling GBP and the Euro EUR have always been a desirable currency pair and it usually falls into the list of least volatile currency pairs. However, most volatile forex pairs 2021, volatility in this pair has increased in recent years due to the ongoing controversy over Brexit. Of the two currencies, the British Pound has been more volatile. When the hype around Brexit abates and relationships between the two great economies stabilise, there should be less volatility in this currency pair.

The Great Britain Pound Sterling GBP and Australian Dollar AUD is another popular currency pair to trade because of their volatility characteristics. Australia has born the brunt of the ongoing trade war between the United States and China, losing out on significant export revenue because China is a major trading partner of Australia.

China also imports a load of other commodities from Australia such as cars, wine, wool and grains as well as aircraft and electronic parts. The Australian Dollar AUD and the Japanese Yen JPY are one of the most volatile currency pairs. Agriculture plays a small role in the value of the currency. The JPY is heavily linked to technology. Despite the JPY serving as a safe-haven currency, it remains volatile for a few reasons.

As the main funding currency for Asia, it is vulnerable to geopolitical turmoil, expanded stock market ranges, and a persistent threat of stimulus interventions by the Bank of Japan. The New Zealand Dollar NZD and the Japanese Yen JPY are another example of a volatile forex pair.

Much like Australia, New Zealand is dependent on its capacity to export commodities, most volatile forex pairs 2021. This mostly includes dairy products, honey, and wood. Again, Japan is linked to technological advancements and is the second-largest developed economy in the free market. Changes in commodity prices affect the NZD. Keeping a check on commodity price movements relative to the stability of the Japanese Yen helps forex traders identify opportunities for successful forex trades.

Canada is a major exporter of crude oil and is heavily reliant on its capacity to trade this valuable commodity. Japan also exports crude oil and thus, the two are set off against each other. If the price of crude oil moves drastically, it becomes costly to buy Canadian Dollars with the Japanese Yen.

This is because more JPY is needed to be converted into CAD to buy a barrel of oil. Of the two, the JPY is a more reliable and stable currency and serves as a safe-haven currency. Forex traders looking for forex trading opportunities in this currency pair keep an eye on what is happening to crude oil prices.

The US Dollar USD and Brazilian Real BRL currency pair is a classic example of a major currency paired with an exotic currency. Exotic currencies are notoriously volatile and are affected by many factors that characterise an emerging market. The BRL is officially a free-floating currency. It replaced the Cruzeiro Real in and bywas the 19 th -most traded currency in the world by value.

The latter influences foreign investment in emerging markets. The US Dollar USD and Turkish Lira TRY is not a popular currency pair but if you have an appetite for volatility and risk, it does present some interesting trading opportunities.

The TRY is very volatile and its value against the USD has fluctuated dramatically over the years. This is largely due to the political and economic upheaval in the country, including contentious elections and coups. The US Dollar USD and Mexican Peso MXN is a notoriously volatile forex pair. The relationship between the US and Mexico has been turbulent since the US elections but the tariffs on Mexican exports that were implemented recently have made the currency pair even more volatile.

The major currency pairs are generally the least volatile. This is because they represent the largest world economies and are the most liquid. The more liquid currency pairs have less volatility and greater trading volume. That in itself creates greater price stability. The Euro and US Dollar currency pair is regarded as the easiest pair to trade as a beginner trader. These four currency pairs are regarded as the least volatile on the forex market.

They are highly liquid currency pairs which mean they are easy to offload quickly in a Bear market. All four currencies are considered to be safe-haven currencies. In volatile market conditions, forex traders and investors will likely convert cash held into these currencies to protect themselves.

The USD retains its status as a safe-haven currency largely due to how reliable the US Treasury is in paying its investors. The USD is the default safe-haven most volatile forex pairs 2021 in times of political and economic upheaval and currency uncertainty. In recent years, the EUR proved to be a safer haven than the USD during the economic and financial crises. This was large because the low-interest rates in major European economies created heightened expectations.

However, with the current negative sentiment surrounding Brexit, the EUR is not as bullish as it could be and investors are inclined to lean towards the USD and JPY while the negotiations play out. In recent years, the JPY has proven to be a safer haven than the USD during the economic and financial crises, most volatile forex pairs 2021. The JPY is also a popular carry trade. In times of financial crisis, investors often sell off riskier financial instruments to pay back Yen loans.

The USD and JPY are currently regarded as the safest safe-haven currencies. The CHF has been most volatile forex pairs 2021 a safe-haven currency for as long as we can remember, most volatile forex pairs 2021. This is largely due to the stability of the Swiss government and its sound financial system. Switzerland is world-renowned for having one of the most stable and safest banking industries, a low-volatility capital market, almost zero unemployment, a most volatile forex pairs 2021 trade deficit, and a high standard of living.

In addition, Switzerland is independent of the European Union. This makes it relatively immune to negative market sentiment surrounding political and economic upheaval in the Eurozone, most volatile forex pairs 2021, including Brexit. Switzerland is also a tax haven for wealthy investors.

There are a number of useful indicators provided on trading platforms that help forex traders measure and assess currency pair volatility. They help identify potential breakouts and good trading opportunities. Price charts are a graphic tool that shows the historic behaviour of the relative price movement of currency pairs in different most volatile forex pairs 2021 frames.

Basically, forex traders rely on past behaviour to predict future price movements. The most common forex charts are line, bar, and candlestick charts. The time frames range from tick data to hourly, monthly, and yearly data. A tick in forex tick charts denotes the change in the price of a currency pair which was caused by a single trade.

When a currency price is trending upward; each subsequent most volatile forex pairs 2021 is higher than the previous one and each subsequent minimum is higher than the previous one. The Moving Average MA is one of the best ways to determine if a market is bullish or bearish.

The MA is represented in the form of a curve that changes according to the direction of the trade. Forex traders typically use a combination of MAs, usually the day MA and day MA. A Bull signal is raised when the price moves above the curve. A Bear signal occurs when the price moves below the curve. The trend is likely to reverse when the price crosses the curve. The potential direction and strength of the price movements in the forex market are reflected in the angle of the slope of the curve.

The most volatile currency pairs

, time: 9:19The Most Volatile Currency Pairs in | Forex Essentials

The following currency pairs have shown the most volatility in AUD/JPY (average volatility – %); AUD/USD (average volatility – %); 22/12/ · The Most Traded Currency Pairs in Forex ( Edition) Entertaining. More than 50% of trades in Forex market somehow involve the US dollar. In fact, EURUSD is the most traded currency pair in the world that takes about 30% of the total multi-billion dollar Forex blogger.comted Reading Time: 5 mins 26/08/ · Currency Pairs and Volatility. After researching the most volatile currency pairs in , it is important to learn some basics about the currency pairs in the forex market and the three main categories. Major Pairs: The major pairs are the most traded major currencies against the US Dollar. These pairs enjoy high levels of liquidity

No comments:

Post a Comment