14/09/ · blogger.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, London Wall, London, EC2Y 5ET. GAIN Global Markets Inc. is part of the GAIN Capital Holdings, Inc. group of companies, which has its principal place of business at US Hwy /, Bedminster, NJ , USA 11/03/ · The Ideal way to trade the EUR/DKK. Trading the EURDKK is different from trading the major/minor currency pairs. And this can be easily figured out from the percentage values. From the table, we can infer that the percentage values are extremely high on the 1H, 2H, and 4H timeframes. This means that the costs in these timeframes are super-high 16/09/ · blogger.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # ). Forex trading involves significant risk of loss and is not suitable for all investors. Full Disclosure. Spot Gold and Silver contracts are not subject

Analyzing The Costs Involved While Trading The EUR/DKK Forex Pair | Forex Academy

This is an exotic pair in the forex market. Typically, this pair is traded with low volumes, how to trade forex eurdkk. Here, EUR is the base currency, and DKK is the how to trade forex eurdkk currency. The current market price in the exchange of this pair depicts the value of Danish Krone equivalent to one euro. It is simply quoted as 1 EUR per X DKK.

For example, if the current value of EURDKK is 7. In the foreign exchange market, spreads are the primary source through which brokers make money. They set a different price for buying and a different price for selling the same currency pair. This difference is referred to as the spread. This spread varies from broker to broker and also from the type of execution model used. This fee is the same fee is paid to the stockbrokers. In other terms, this is the commission that is paid to the broker.

The fee on ECN accounts is between pips, while it is nil on STP accounts. The difference between the price at which the trader executed the trade and actual executed price how to trade forex eurdkk called the slippage on the trade. As the name partially suggests, the trading range is a range of pip movements in a currency pair in different timeframes. Pip movement is also referred to as the volatility values.

The total cost of the trade is determined by summing up the slippage, spread, and the trading fee. And this cost is not fixed.

It varies based on the volatility of the market. Below is the tabular representation of the cost variation, which is signified in percentages. Note : The costs may seem significantly high because of the Spreads. As we know, these Spreads keep changing from time to time.

At times we have seen the spreads for this pair being as low as But we have considered maximum spread to give you the maximum cost percentages. And this can be easily figured out from the percentage values.

From the table, we can infer that the percentage values are extremely high on the 1H, 2H, and 4H timeframes. This means that the costs in these timeframes are super-high.

Hence, trading this pair on these lower timeframes is a bad decision. However, if we look at the next three rows 1D, 1W, and 1Mwe can see that the percentage values are significantly lower than the above values.

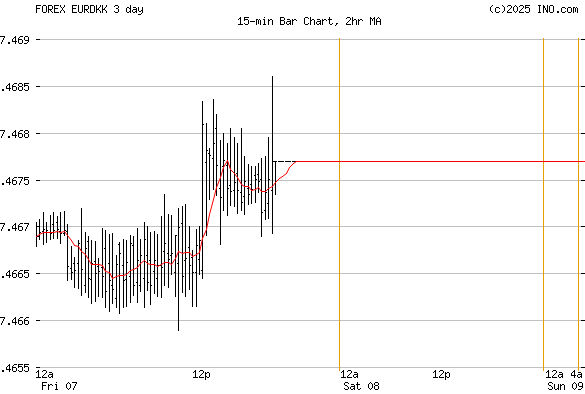

Hence, this makes this pair tradable on the daily, weekly, and monthly timeframes. Consider the charts of EURDKK on the 1H and the 1D timeframe. On the 1H timeframe chart, we can see that there is barely any movement in the price. Also, volatility is high here. On the other hand, on the 1D timeframe, there is enough movement in the prices, and the volatility is not very high as well. Hence, making it the ideal timeframe to trade, how to trade forex eurdkk. Moreover, a simple and effective way to reduce costs is by trading using limit and stop orders instead of market orders.

In doing so, the slippage will be completely nullified. Hence, the total cost will significantly reduce. Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us. Forex Academy. RELATED ARTICLES MORE FROM AUTHOR.

Gold Market Analysis and Structure. Investing In Silver the Forex Way, how to trade forex eurdkk. LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your how to trade forex eurdkk here. You have entered an incorrect email address!

Popular Articles. Forex Chart Patterns Might Be an Illusion 4 September, How Important are Chart Patterns in Forex? Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, offering educational information to those who are interested in Forex trading, how to trade forex eurdkk.

EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL How to trade forex eurdkk RESERVED.

How Banks Trade Forex: 3 Institutional Forex Trading Secrets Banks Don't Want You To Know

, time: 15:3011/03/ · The Ideal way to trade the EUR/DKK. Trading the EURDKK is different from trading the major/minor currency pairs. And this can be easily figured out from the percentage values. From the table, we can infer that the percentage values are extremely high on the 1H, 2H, and 4H timeframes. This means that the costs in these timeframes are super-high EUR/DKK. This market's chart. This is a visual representation of the price action in the market, over a certain period of time. You can use this to help gauge a market’s performance. The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1% 16/09/ · blogger.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # ). Forex trading involves significant risk of loss and is not suitable for all investors. Full Disclosure. Spot Gold and Silver contracts are not subject

No comments:

Post a Comment