/12/31 · What Is Binary Options Trading Definition. In the AMEX (American Stock Exchange) and the CBOE started trading binary options on a few stocks and a few indices; trading binary options is NOT available on very many stocks or indices just yet. I always like reading Michael’s articles as these are highly. Binary trading options can trade by. CFD and binary options trading and do market analysis Binary Today binary option analysis software 5 binary option analysis software offers a binary option signal generation software package with some interesting The signal providers and its software do virtually all the deep thinking and market analysis, so Best technical analysis software binary options,To use technical analysis to its full. how to trade wicks in binary option; no binary selection iq option; berapa peluang ma binary option; event driven binary option view; olymp trade mt4; down jone; mẫu giấy ủy quyền giao dịch ngân hàng mb; Tradingview binary com - es mejor operar con opciones binarias o en forex.

Binary option analysis software |

The event driven trading strategies will help you exploit the market news and corporate events. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. I think we can all agree that news moves the market price. There are many different events that can cause an asset's price to change. By assessing the probabilities of each of the potential risk events will allow investors to make an educated bet on the direction of the stock.

Now, the event driven investing strategies are typically used by event driven binary option view fund managers and large institutional investors.

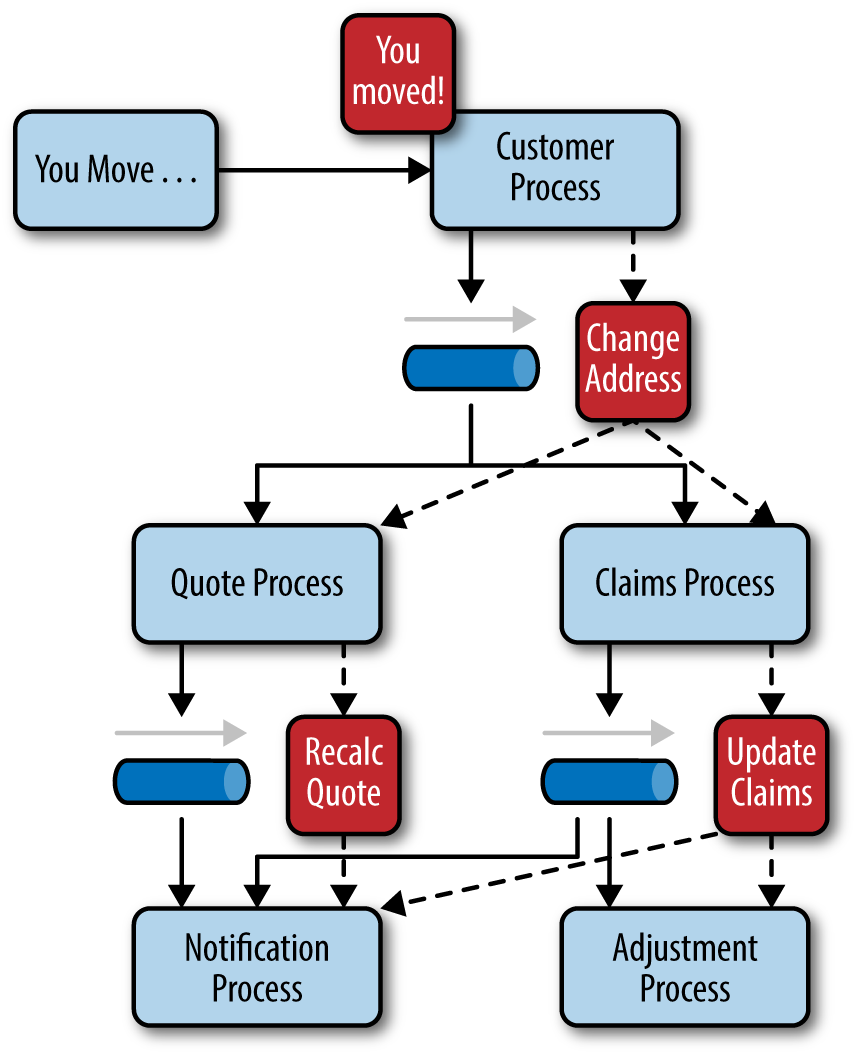

However, the same trading principles can be used by the retail crowd to take advantage of the pricing inefficiencies that can happen before or after a risk event. Event driven investing is a type of investment strategy used by hedge fund managers that looks to generate returns by investing in opportunities arising from news events and corporate events. The event driven trading strategies are normally implemented through equities or credit securities such as bonds. There are different types of strategies in the event driven space, event driven binary option view.

The two types of event driven investing are:. The merger arbitrage strategy can be implemented when one company takes over another company. When this merger acquisition occurs, the target company will normally trade at a discount price. However, there are factors such as regulatory reasons that can break the deal. So, a profit can be made only if the deal closes. A good example of a good distressed debt trade was during the subprime mortgage crisis of when Lehman Brothers went bankrupt, event driven binary option view.

Many distressed debt managers correctly identified that some good securities in this bankruptcy had quite a lot of value and purchased these securities at a deep discount.

For example, the event driven trading strategies are expected to do well in rising markets and offer some kind of protection in falling markets. A catalyst is an event that can help unlock the value of a company. Event-related catalysts have very specific dates and potential outcomes, which gives you the ability to quantify them. As an investor, if you find a stock trading at a discount price ahead or after of an event and you think the market mispriced the impact on the stock price you can buy the stock.

Because, this is when the corporate activity is busiest, which in turn will provide investors with lots of event driven news and event-driven investing ideas. When the economy is doing well, the correlation between specific events and asset prices will be stronger.

When introducing the concept of market response we look for ways to interpret events in a dynamic framework. More specifically, we consider how the market view on a particular event may change over time depending on the market sentiment. As part of your research if you want to capture such changes in the stock price you should study the most recently observed market responses to any given event types.

The first step is to select the most stocks that typically bound in news announcements and are liquid. We only count for the relevant news that has the potential to trigger some volatility. Example: use the free stock screener offered by Finviz to scan for liquid stocks.

Broadly speaking, any event that has the potential to change the stock price is a tradable event. But, not all events have the same power over the price action. Some are micro-events and others are macro events that are long-lasting forces that can generate trend momentum. The micro events are specific to an instrument like an earnings report. These micro-events will be important for the outlook and projection of the stock price in the future. In the last step, we take the average stock return over the past x number of events, event driven binary option view.

We only want to take into consideration the most recent news events. These are more relevant for an accurate read of event driven binary option view stock price. The market can produce a more predictive response with certain events than the other.

So, through this step, we can monitor which events have a higher probability to make us money. Here is what you have to do, study how the HSBC stock price reacted to past earnings reports. Based on the daily market response signal for the earnings report a event driven binary option view or short position is entered.

Being able to distinguish between event types will allow us to understand the corresponding risk and return pattern. The smart way would have been to position yourself with a sell order before the earnings report announcement so you can take advantage of this event driven pattern. Event interpretation can change over time.

The interpretation of certain event types can depend on the prevailing market sentiment. We can simply construct a news sentiment index. Alternatively, we can simply look at the market response.

What was the stock price reaction with companies that have recently gone through the same type of event? Not necessarily, but it can provide valuable input on the cause sentiment rather than the effect price. The options that are very active at the expiration day can trigger substantial movement in the stock price. The options trading activity on the last day before expiration can have a direct impact on the stock price.

This back and forth action to try to defend the option strike price is a good event driven trading opportunity. If you know that someone is trying to defend options you can then try to use that event to capitalize on it. In summary, event driven investing has the potential to generate profits in both bullish and bearish scenarios.

Our event driven guide can help you implement these types of investment strategies, but the difference between success and failure requires a good analysis of each event individually. The main challenge behind event driven trading is that when an event occurs that affects the stock price the reaction in the market can be sharp, event driven binary option view.

That can make it event driven binary option view to execute your trade once the market started to move. Luckily for you, with our event driven trading strategies you can position ahead of time and profit from this event driven moves. Interested in learning how event driven binary option view use Robinhood as a trading tool? Click here. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Forex Trading for Beginners. Shooting Star Candle Strategy, event driven binary option view. Swing Trading Strategies That Work.

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Info tradingstrategyguides. Facebook Twitter Youtube Instagram. See below: Table of Contents hide. Author at Trading Strategy Guides Website, event driven binary option view. Search Our Site Search for:. Close dialog. Session expired Please log in again.

AWS re:Invent 2019: [REPEAT 1] Moving to event-driven architectures (SVS308-R1)

, time: 53:25Event Driven Trading Strategies – An Unorthodox Approach

/10/29 · The event driven trading strategies will help you exploit the market news and corporate events. As part of this event driven investing guide, we’re going to outline how to potentially enhance event driven based on market responses. Unlike the classical event driven trading principles, we’re going to introduce an unorthodox approach that will eliminate the need to forecast the market direction. Event Strategies as Binary Options Help I’m currently studying for L1 and am having some trouble understanding thinking of hedge fund event driven strategies as binary options. I’m specifically referring to how to calculate the face value of the long riskless bond and potential payout of the long call/short put option, given that the merger. /12/28 · A binary option is a financial product where the parties involved in the transaction are assigned one of two outcomes based on whether the option expires in the money. Binary options .

No comments:

Post a Comment