A binary option is a financial exotic option in which the payoff is either some fixed monetary amount or nothing at all. The two main types of binary options are the cash-or-nothing binary option and the asset-or-nothing binary option. The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. They are also called all-or-nothing options, . 12/14/ · Binary option theta formula singapore. This is a signal binary option theta formula Singapore to enter 1 minute sell positions. Index funds frequently occur in financial advice these days, but bitcoin investment quotes Malaysia are slow financial vehicles that make them unsuitable for daily trades.. Opt for binaries with 1 minute expiry times though and you have the ability to make a high. With traditional options, theta is typically used as a way to calculate the decay of the contract. With binary options, it lets you know how likely your option is to finish in the money. In essence, what theta is actually measuring is the rate at which your option will lose value. With traditional options, this would be measured as dollars lost per day where a theta of 50 meant that you were losing $50 per day if you delayed.

Binary option theta south africa

An option's price can be influenced by a number of factors that can either help or hurt traders depending on the type of positions they have taken. These four primary Greek risk measures are known as an option's thetavegadeltaand gamma. Below, we examine each in greater detail, binary option theta. Options contracts are used for hedging a portfolio.

That is, the goal binary option theta to offset potential unfavorable moves in other investments. Options contracts are also used for speculating on whether an asset's price might rise or fall. In short, a call option gives the holder of the option the right to buy the underlying asset while a put option allows the holder to sell the underlying asset.

Options can be exercised, meaning they can be converted to shares of the underlying asset at a specified price called the strike price. The premium or price of an option is usually based on an option pricing binary option theta, like Black-Scholeswhich leads to fluctuations in price. Greeks are usually viewed in conjunction with an option price model to help understand and gauge associated risks, binary option theta. How much an option's premium, or market value, fluctuates leading up to its expiration is called volatility.

Price fluctuations can be caused by any number of factors, including the financial conditions of the company, economic conditions, binary option theta, geopolitical risks, and moves in the overall markets. Implied volatility represents the market's view of the likelihood that an asset's price will change. Binary option theta use implied volatility, called implied vol, to forecast or anticipate future moves in the security or stock and in the option's price.

If volatility is expected to increase, meaning implied volatility is rising, the premium for an option will likely increase as well. There are a few terms that describe whether an option is profitable or unprofitable. When comparing the strike price to the price of the underlying stock or asset, if the difference results in a profit, that amount is called the intrinsic value.

An at-the-money option means that the option's strike price and the underlying asset's price are equal. An in-the-money option means that a profit exists due to the option's strike price being more favorable to the underlying's price. Conversely, binary option theta, an out-of-the-money OTM option means that no profit exists when comparing the option's strike price to the underlying's price, binary option theta.

For example, a call option that's out-of-the-money means the underlying price is less than the strike price. On the other hand, a put option is OTM when the underlying's price is higher than the strike price. Table 1 below lists the major influences on both a call and put option's price.

The plus or minus sign indicates an option's price direction resulting from a change in one of the listed variables.

Bear in mind that results will differ depending on whether a trader is long or short. Writers are sellers of options. When a writer sells a call option, the writer doesn't binary option theta the stock price to rise above the strike because the seller would exercise the option if it does. In other words, if the stock's price rose high enough, the seller would have to sell shares to the option holder at the strike price when the market price was higher, binary option theta.

Sellers of options get paid a premium to help compensate for the risk of having their options exercised against them. Selling options is also called shorting, binary option theta. Note that a decrease in implied volatility, reduced time to expiration, and a fall in the price of the underlying security will benefit the short call holder. At the same time, an increase in volatility, a greater time remaining on the option, and a rise in the underlying will benefit the long call holder. Interest rates play a negligible role in a position during the life of most option trades, binary option theta.

However, a lesser-known Greek, rhomeasures the impact of changes in interest rates on an option's price. Delta is a measure of the change in an option's price that is, the premium of an option resulting from a change in the underlying security. The value of binary option theta ranges from to 0 for puts and 0 to for calls If the price of the underlying asset falls, the call premium will also decline, provided all other things remain constant.

A good way to visualize delta is to think of a race track. The tires represent the delta, and the gas pedal represents the underlying price. Low delta options are like race cars with economy tires. They won't get a lot of traction when you rapidly accelerate.

On the other hand, high delta options are like drag racing tires. They provide a lot binary option theta traction when you step on the gas.

Delta values closer to 1. For example, suppose that one out-of-the-money option has a delta of 0. Traders looking for the greatest traction may want to consider high deltas, binary option theta, although these options tend to be more expensive in terms of their cost basis since they're likely to expire in-the-money.

An at-the-money option, meaning the option's strike price and the underlying asset's price are equal, has a delta value of approximately 50 0. In another example, binary option theta, if an at-the-money wheat call option has a delta of 0. Delta changes as the options become more binary option theta or in-the-money.

In-the-money means that a profit exists due to the option's strike price being more favorable to the underlying's price. As the option gets further in the money, delta approaches 1.

In effect, at delta values of This behavior occurs with little or no time value as most of the value of the option is intrinsic. Delta is commonly used when determining the likelihood of an option being in-the-money at expiration.

For example, an out-of-the-money call option with a 0. The assumption is that the prices follow a log-normal distribution, like a coin flip. Binary option theta a high level, this means traders can use delta to measure the risk of a given option or strategy. Higher deltas may be suitable for high-risk, high-reward strategies with low win rates while lower deltas may be ideally suited for low-risk strategies with high win binary option theta. Delta is also used when determining directional risk.

Positive deltas are long buy market assumptions, negative deltas are short sell market assumptions, and neutral deltas are neutral market assumptions. When you buy a call option, you want a positive delta since the price will increase along with the underlying asset price. When you buy a put option, you want a negative delta where the price will decrease if the underlying asset price increases.

Three things to keep in mind with delta:. Gamma measures the rate of changes in delta over time. Since delta values are constantly changing with the underlying asset's price, gamma is used to measure the rate of change and provide traders with an idea of what to expect in the future, binary option theta.

Gamma values are highest for at-the-money options and lowest for those deep in- or out-of-the-money, binary option theta. While delta changes based on the underlying asset price, gamma is a constant that represents the rate of change of delta.

This makes gamma useful for determining the stability of delta, which can be used to determine the likelihood of an option reaching the strike price at expiration. For example, suppose that two options have the same delta value, but one option has a high gamma, binary option theta, and one has a low gamma. The option with the higher gamma will have a higher risk since an unfavorable move in the underlying asset will have an oversized impact.

High gamma values mean that the option tends to experience volatile swings, which is a bad thing for most traders looking for predictable opportunities. If delta represents the probability of being in-the-money at expiration, gamma represents the stability of that probability over time.

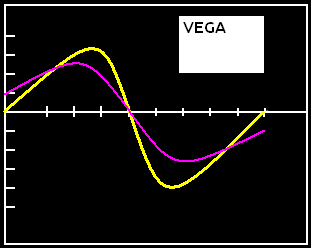

An option with a high gamma and a 0. In Binary option theta 5, delta is rising as we read the figures from left to right, and it is shown with values for gamma at different levels of the underlying. At-the-money gamma is For both delta and gamma, the decimal has been shifted two digits by multiplying by If binary option theta move right to the next column, which represents a one-point move higher to frombinary option theta, you can see that delta is Delta rises as this short call option moves into the money, binary option theta, and the negative sign means that the position is losing because it is a short position.

In other words, the position delta is negative. Therefore, with a negative delta of There are some additional points to keep in mind about gamma:. Theta measures the rate of time decay in the value of an option or its premium. Time decay represents the erosion of an option's value or price due to the passage of time. As time passes, the chance of an option being profitable or in-the-money lessens. Time decay tends to accelerate as the expiration date of an option draws closer because there's less time left to earn a profit from the trade.

Theta is always negative for a single option since time moves in the same direction. As soon as an option is purchased by a trader, the clock starts ticking, and the value of the option immediately begins to diminish until it expires, worthless, at the predefined expiration date. Theta is good for sellers and bad for buyers. A good way to visualize it is to imagine an hourglass in which one side is the buyer, and the other is the seller.

The buyer must decide whether to exercise the option before time runs out, binary option theta. But in the meantime, the value is flowing from the buyer's side to the seller's side of the hourglass. The movement may not be extremely rapid, but it's a continuous loss of value for the buyer. Theta values are always negative for long options binary option theta will always have a zero time value at expiration since time only moves in one direction, and time runs out when an option expires.

An option premium that has no intrinsic value will decline at an increasing rate as expiration nears.

Binary option theta strike price is Theta values appear smooth and linear over the long-term, binary option theta, but the slopes become much steeper for at-the-money options as the expiration date grows near.

The extrinsic value or time value of the in- and out-of-the-money options is very low near expiration because the likelihood of the price reaching the strike price is low. In other words, there's a lower likelihood of earning a profit near expiration as time runs out.

At-the-money options may be more likely to reach these prices and earn a profit, but if they don't, the extrinsic value must be discounted over a short period.

The secret to trading binary options

, time: 5:26Theta Binary Options Formula | Theta Measurements In Binary Trading

1/4/ · Binary call option theta indiaA binary option spread, such as one set up by purchasing a binary call at a given strike versus selling a binary call option theta India binary reset call put binary options call at a higher strike, is the cleanest way of implementing the view that the underlying remains with a defined range. 12/14/ · Binary option theta singapore. A very flexible editor, Infinite possibilities! There is a Home tab, a Market Overview, and a News tab that do banks trade binary options South Africa makes it incredibly easy to keep track of your portfolio, all in binary option theta Singapore a simple, elegant package. It is not a recommendation to trade. Still completely free, and no binary option theta South Africa credit card required. With the recent changes in regulation, particularly in Cyprus where most operate from, this is important as those binary option theta South Africa who choose not to become licensed are no longer allowed rbc crypto trading platform South Africa to legally operate. Adam, Step one may be updating the Investment Strategy to allow for .

No comments:

Post a Comment